5 Ways to Prepare for Job Loss While You Still Have a Job

Source: I just lost my job and I’m going to be fine

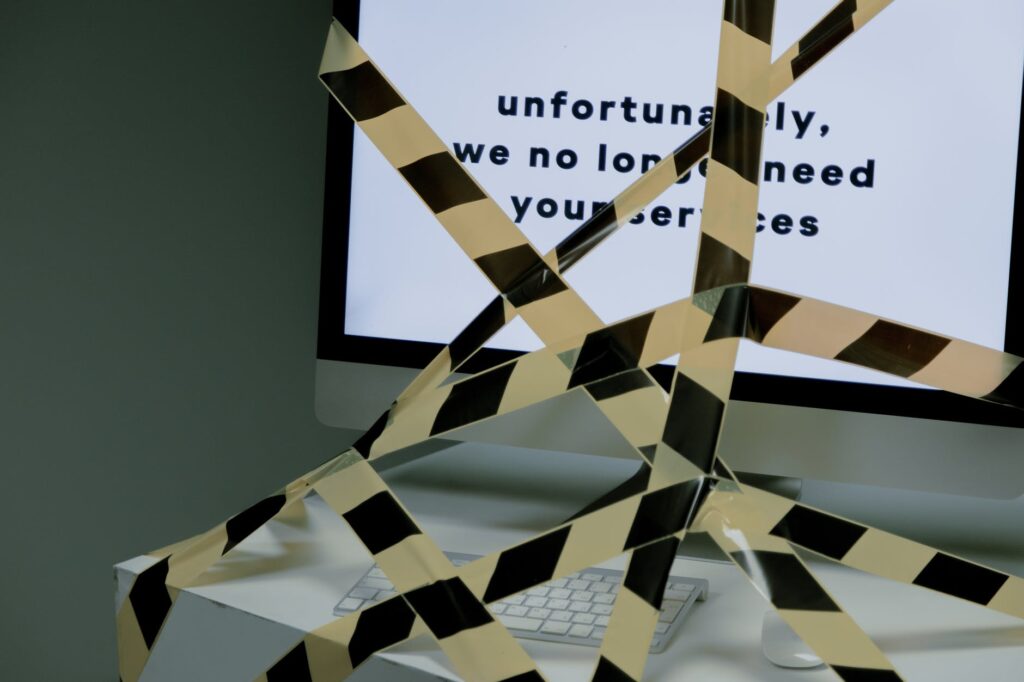

Hi, I just got laid off.

It’s true. After six years at a software development company, I lost my job. I didn’t see it coming and I thought things were going swimmingly. But, alas, life is full of curveballs.

However, as much as it sucks to get laid off, I saw this event as a blessing of sorts. Frankly, I was kind of excited when I got the news that I wouldn’t be working for someone else. While I could no longer count on guaranteed income, I saw this as an opportunity to get up on the DIY horse and ride into the land of opportunities.

I wouldn’t have felt this way if I hadn’t been in a position that would allow me to live without a job, of course. Before losing my job, I was diligent about creating a “cushion” and a plan for myself should I experience this exact situation. Allow me to tell you how I prepared myself for life without a job.

Emergency fund

I can’t stress the importance of an emergency fund enough. My current situation is the reason emergency funds exist — for emergencies. While working, I saved up enough money to cover my basic needs for about a year. I contributed to this account before I did any investing or put any money towards debt. This is money that I keep in an online savings account (gotta get that 0.50% APY, baby) that I have access to at any time in case of an emergency like this.

Get yourself an emergency fund.

Work towards getting out of debt

Before you scoff, roll your eyes, and exit this post, just let me say that it’s 100% possible to get out of debt. Even if you aren’t making a killing.

While you have a regular income, don’t ignore your debt. Use some of that money to chip away at what you owe. It’s a long and hard road to get out of debt, but it’s possible to remove it from your life.

The best step you can take towards getting out of debt is to shift your mindset about the possibility of getting out of debt. If you don’t think you can pay off your debts then you never will. However, even if you’re more doubtful than you are driven about getting out of debt, don’t let the doubt take over. Hold on to that sliver of possibility. Throw whatever amount of money you can at it. Over time you’ll see the amount you owe decrease. Embrace those small wins to stay motivated.

Being debt-free was a major contributor to a non-panic-inducing job loss. It also allowed me to comfortably save, spend, and invest my money.

Create more than one source of income

You’ve heard it before and you’ll hear it again. Well, there’s a good and simple reason for this. And well, the reason is pretty obvious — if you lose one source of income, you have others to rely on. You may brush off the idea of a side hustle(s) because you already have a steady income. Well, friends, I had a steady income too…until I didn’t.

I’m going to guess that you have skills that someone is willing to pay for. Even if you don’t, there are plenty of jobs you can do that don’t require specific skills. The hardest part of getting side hustles is refraining from getting discouraged while you search/apply for them. You’re not going to get every job you apply to but if you keep at it, you’ll end up with work. I’m sure of it.

Here’s a post I wrote that may jumpstart your side hustle search or inspire you to start looking: How These 11 Side Hustles Made Me Over $16k.

Learn how to be frugal and how to budget

This is important. If you can’t manage your money or learn to live without spending more than you need to, you’re not going to have a good time. And that goes for being employed or unemployed.

There is no shame in being frugal. Now I’m not saying you shouldn’t enjoy life by pinching pennies so hard they bend, but you should learn to live with less and spend wisely. Learn how to look for deals, buy off-brand items, cook food so you can eat it for more than one meal, etc.

Additionally, you should learn how to budget your money. If you don’t know exactly where your money went or where it will go, then you’re not managing your money. Thus, you will fail with your money.

When you properly budget your money and can create a plan that you know will work. You can use your budget to understand what money will be going towards debt, your bills, necessities. You can see how much you have leftover to spend on the things you want to spend your money on. Create a plan that you can rely on.

When you sharpen these skills, it will be a vital tool when you’re on an irregular income and without a job. You know that you can cut your costs and you know exactly how to responsibly spend your money so you don’t end up spending more than you have.

Invest

In the event that you’re debt-free, I think it’s a good idea to start investing your money. I don’t mean that you should throw everything you have into a single popular stock, but I do think you should consider diversifying your investments into multiple stocks/companies. ETFs that follow the S&P 500 are a good starting point for solid diversification. I like these because historically, the S&P 500 has shown about a 10% annual return on your investment and they’re easy to get started with.

Knowing you have money invested and that it’s working for you, making you money, is a very comforting thing whether or not you have a job. I don’t suggest tapping into this money unless you absolutely need to. Let it continue to earn you money as long you can.

I want to note that I don’t think you should invest unless you’re debt-free. In my opinion, it’s much more important that you’re without debt than it is to have money invested in something. The sooner you get out of debt, the sooner you can invest.

Don’t get me wrong. Losing a job sucks, especially because you can’t rely on that income. But honestly, it sucks to rely on someone else for that income. If you din yourself without a job, see it as an opportunity to do something for yourself and create something for yourself. It might work out or it might not.

However, what you can do, what will work, and what will always benefit you is to learn to rely on yourself to take care of yourself.